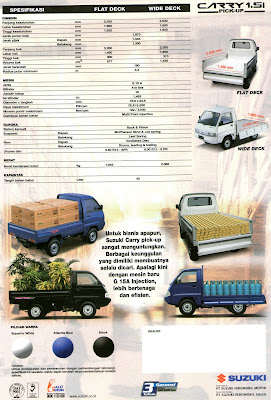

Mega Carry Pick Up FD dan Mega Carry Pick Up WD

Berikut brosur resmi mega carry pick up FD dan mega carry WD. kedua unit ini merupakan keluaran dari brands suzuki dan unggulan dari suzuki untuk melayani pelanggan setia suzuki dengan memfasilitasi mereka dengan baik dan membantu Bisnis Anda.

Mega Carry Pick Up FD

Bak yang terbuka Hanya belakang

Spesifikasi

Dimensi

Panjang keseluruhan 4,155mm

Lebar keseluruhan : 1,680mm

Tinggi keseluruhan : 1,865mm

Jarak sumbu roda : 2,625mm

Jarak pijak depan : 1,435mm

Jarak pijak belakang : 1,435mm

Panjang bak : 1,585mm

Tinggi bak : 365mm

Jarak terendah : 190mm

Radius putar minimum : 4,9mm

Mesin

Jenis : G15A

Silinder : 1493 cc

Jumlah katup : 16

Jumlah silinder : 4

Diameter x langkah : 75,0 mm x 84,5 mm

daya maksimum : 92,4 PS / 6000 rpm

Momen puntir maksimum : 126 Nm / 3000 rpm

Rangka

Sistem kemudi Rack dan pinion

Suspensi depan Macpherson strut & Coll spring

Suspensi belakang Rigit axie, Leaf Spring

Rem Depan Ventilated Disc

Rem Belakang Drum, Leading dan Trailing

Ukuran Ban 185R14C

Berat

Berat kendaraan 1,950 kg

Mega Carry Pick Up WD

Ketiga bak terbuka untuk bak kanan, kiri, dan belakang

Spesifikasi

Dimensi

Panjang keseluruhan 4,155mm

Lebar keseluruhan : 1,680mm

Tinggi keseluruhan : 1,865mm

Jarak sumbu roda : 2,625mm

Jarak pijak depan : 1,435mm

Jarak pijak belakang : 1,435mm

Panjang bak : 1,585mm

Tinggi bak : 365mm

Jarak terendah : 190mm

Radius putar minimum : 4,9mm

Mesin

Jenis : G15A

Silinder : 1493 cc

Jumlah katup : 16

Jumlah silinder : 4

Diameter x langkah : 75,0 mm x 84,5 mm

daya maksimum : 92,4 PS / 6000 rpm

Momen puntir maksimum : 126 Nm / 3000 rpm

Rangka

Sistem kemudi Rack dan pinion

Suspensi depan Macpherson strut & Coll spring

Suspensi belakang Rigit axie, Leaf Spring

Rem Depan Ventilated Disc

Rem Belakang Drum, Leading dan Trailing

Ukuran Ban 185R14C

Berat

Berat kendaraan 1,950 kg

|

By Yoshio Takahashi

TOKYO--Suzuki Motor Corp. said Thursday its net profit rose 19.2% in

the April-December period, as solid sales in Asia and the weakening yen

helped improve its bottom line.

Yet Suzuki kept its net profit outlook at 70 billion yen ($753 million)

for the current fiscal year through March, unchanged from its previous

forecast.

The small car manufacturing specialist has said it is narrowing its

focus to fast growing Asian markets including India, where Suzuki enjoys

the highest market share.

The company on Wednesday outlined a plan to restart local production in

Myanmar after a two-year suspension, eyeing this untapped Asian market

as another potential source of growth.

The move comes after the company late last year decided to pull out of

the U.S. market. Suzuki's product lineup doesn't match well with demand

for light trucks and relatively large cars in the world's second biggest

car market.

Suzuki posted a net profit of Y48.43 billion in the nine months ended

December, up from Y40.62 billion in the same period a year earlier.

Sales in the April-December period were almost unchanged at Y1.82 trillion from Y1.80 trillion the year before.

For the 12-month period, the car maker kept its sales projection at Y2.6 trillion.

Suzuki reports earnings under Japanese accounting standards.

Pankaj Pandey: Yen weakness has got a lot of role to play in terms of the kind of price appreciation in Maruti but from a number perspective also we see improvement happening because last year was a bit of a abnormal year for the company wherein you had strike and that impacted volumes.

So in that sense and from a EPS perspective we are expecting about 100 kind of EPS in FY14. And in FY15 we expect even better set of numbers so about 132 so in that sense the stock is available relatively quite attractive compared to lot of other two wheeler players so in that sense one can still look at this particular counter.

Also, last quarter results have been improvement in EBITDA margins and probably going forward once if the government does the correction in terms of the kind of diesel vehicles, this company has got a good petrol portfolio, so in that sense this company would be a beneficiary of that and which is why we are positive on the stock and we have a target price of Rs 1,780 on the stock.

Pankaj Pandey: Yen weakness has got a lot of role to play in terms of the kind of price appreciation in Maruti but from a number perspective also we see improvement happening because last year was a bit of a abnormal year for the company wherein you had strike and that impacted volumes.

So in that sense and from a EPS perspective we are expecting about 100 kind of EPS in FY14. And in FY15 we expect even better set of numbers so about 132 so in that sense the stock is available relatively quite attractive compared to lot of other two wheeler players so in that sense one can still look at this particular counter.

Also, last quarter results have been improvement in EBITDA margins and probably going forward once if the government does the correction in terms of the kind of diesel vehicles, this company has got a good petrol portfolio, so in that sense this company would be a beneficiary of that and which is why we are positive on the stock and we have a target price of Rs 1,780 on the stock.